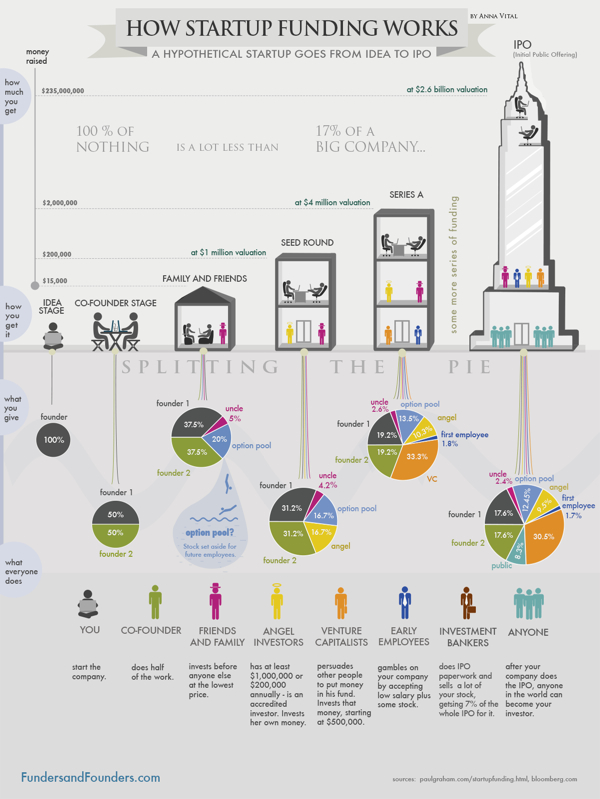

The infographic below is a very good overview of startup funding, particularly for first-time entrepreneurs, from our friends at Funders and Founders.

For new entrepreneurs the chart can be a tad overwhelming. When you’re scraping for your first few dollars from friends and family it’s hard to look ahead at the metrics for your IPO in 5-10 years.

The math, logical and psychology surrounding the premoney and postmoney valuation is the most important aspect that every first time entrepreneur has to grasp. Entrepreneurs are focused on the cash that they need to make the idea a reality, or to take it to profitability. Investors’ issues are entirely different. Most entrepreneurs quickly realize the chasm, and start to pitch in terms of a huge return-on-investment potential. This is too simplistic. Experienced investors think of start-up funding in terms of stages – with each stage ideally making their on-paper investment more valuable.

If you’re going to be raising money from professional investors (not friends and family), then it helps to understand how these investors think – not about whether or not they will invest (that’s a whole ‘nother field of study) – but in how they view their investment in your company in the long term. The entrepreneur is mainly thinking about how much cash he/she needs and how they will leverage it to build their company. Ironically, for these visionary entrepreneurs, this is relatively short-term thinking. When it comes to valuation – Venture Capitalists and professional Angel Investors are the real visionaries. These investors need to far ahead and imagine several successive rounds of funding – most may come from other investors – and determine, 5 years from now, how much their original investment will be worth.

While the infographic below may seem like eye-candy or an eye-chart, it really does elegantly pack in a breadth and depth of the venture/valuation concepts. It’s worth some serious scrutiny. For first-time entrepreneurs, there’s probably not enough context in this one illustration; for advisors, mentors and investors, it’s a terrific visual aid to explain about startup investing and valuation.

How Funding Works – Splitting The Equity With Investors – Infographic.