I can predict it with near certainty. In every single conversation I have with an entrepreneur, or rather with a first-time entrepreneur, it becomes very apparent they place an comically high value on the one, single, good idea that they have. Whether they say it out loud (“this is a billion dollar idea!”) or by asking me to sign an NDA before I even know their name, they are clearly implying their idea, the thought, carries all the value.

Omnipotent Ideas

Often these entrepreneurs feel their idea is so extraordinary that apparently there’s no need to do a basic Google search to see if anyone else out there is working on the idea. No need, of course; the idea is so brilliant that no one could possibly have thought of it before.

Yes, I am dripping with sarcasm today because this sad phenomenon is so pervasive it has become a form of entertainment for me.

Behind their backs

In private conversations with fellow investors or fellow serial entrepreneurs, we both lament and parody the newbie-entrepreneur’s worship and reverence for their idea. Of course the idea-worship lasts until they learn a new word: Pivot – which these days means: “Our idea was so bad and so wrong that no one in the market would give it the time-of-day, so instead we’ll just trash it and try to come up with another idea. But the lost time, money and opportunity is OK, because, well – because we’re pivoting!”. But when we talk about newbie-entrepreneurs behind their backs, mainly we lament how they stress the idea over the ‘execution’ of the idea.

In the end – as well as in the beginning and the middle – execution is everything. Investors and experienced entrepreneurs always understood that a mediocre idea, executed well – is worth a fortune; and a brilliant idea, executed badly – costs a fortune. A simple example: Facebook, the company, its growth and social impact are the stuff of legends. But when the company started in 2004, no other company dominated the social networking market quite like MySpace – particularly after their half-billion dollar acquisition by News Corp. There was also the social networking pioneer, Friendster. In comparison, Facebook actually seemed like a fairly mediocre idea, at best, and a late-to-market, at worse. But Zuckerberg and his advisors executed brilliantly, with consistency and intensity. Today Myspace and Friendster are each a poster child for ‘bad execution’.

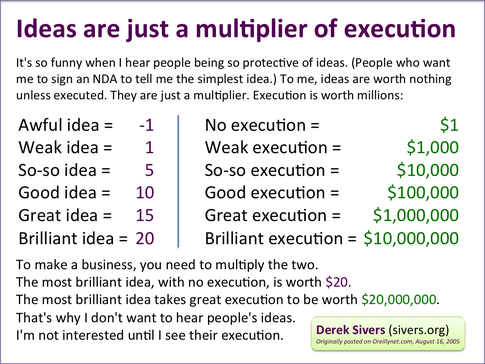

Does this mean that ideas are worthless? Of course not. I’ve struggled to articulate value of the initial idea within the context of the overall value of an entrepreneurial venture. A few years ago, serial entrepreneur and thought leader Derek Sivers posted a brilliant chart illustrating the part an idea plays in the ultimate value of the idea:

The notion of the initial “idea” being a minor multiplier is a powerful one. Derek actually posted this illustration a few years ago, and I wished I had seen it sooner. It’s so much easier to show the graphic to fledgling entrepreneurs now.

However, a few more great examples would be wonderful: Examples of (otherwise) mediocre ideas, executed beautifully by a talented entrepreneur. Anyone?

This is really a challenge because almost every idea, after it has been executed, looks like a great idea, no? Take Twitter. If things had gone differently, Twitter might have merely been a lame alternative to text-messaging instead of the social phenomenon and driver of free speech that it is today.

So, entrepreneurs, instead of trying to convince investors and customers how brilliant and original your idea is – perhaps you should try to convince them of how exceptionally well you will execute … and show them this chart.